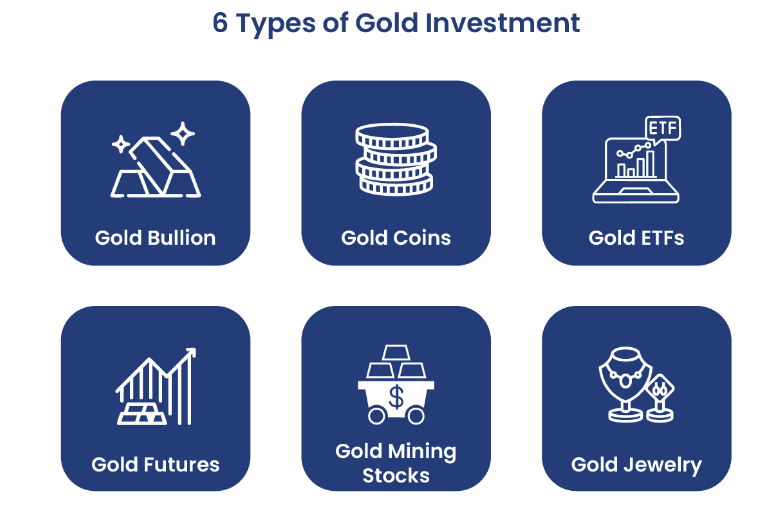

Gold is a symbol of wealth that has been around for centuries. Individuals purchase gold in the form of jewelry, coins, or bars, but a second means of investing in gold is gaining traction: gold options. In this blog, we will discuss what gold options are, how they operate, their advantages and disadvantages, and why they could be a great investment for individuals. If you are a new investor or interested in gold, this guide will make the gold options easy to understand for you.

What Are Gold Options?

Gold options are money contracts based on the price of gold. Rather than buying physical gold, a gold option can be used to buy or sell gold at an agreed rate prior to a given date. It offers flexibility and a chance to make profits when the price of gold goes up or down.

There are two main types of gold options:

Call Options: These give you the right to buy gold at a set price, called the strike price, before the option expires. You might buy a call option if you think gold prices will rise. If gold’s market price goes above your strike price, you can buy it cheaper through your option or sell the option for profit.

Put Options: These give you the right to sell gold at the strike price before expiration. Put options are useful if you believe gold prices will fall. If the market price drops below your strike price, you can sell gold at the higher strike price or sell the option itself for a gain.

Key Points About Gold Options:

- You do not have to buy or sell gold, you just have the right. If your price prediction is wrong, you can skip the option but lose the premium paid.

- Options have an expiration date. You must decide to exercise or sell the option before it ends.

- Gold options usually cover a specific amount of gold, such as 100 ounces of gold futures.

Why People Invest in Gold Options

Investors like gold options because they cost less upfront than buying physical gold or gold futures. They are also great for hedging or protecting other investments from gold price changes.

Here is why gold options are popular:

- Potential for High Returns: Small price differences in gold can lead to big gains.

- Flexibility: Call and put options let you earn if gold prices rise or fall.

- Lower Initial Investment: You pay a premium, which is much less than buying gold itself.

- Hedging: Protect your portfolio during uncertain economic times.

- Risk Management: Full loss is restricted to the premium, unlike physical gold, which can lose value.

How Gold Options Work: An Example

Suppose gold is trading at $1,900 an ounce and you believe it will earn value in the next three months. You buy a call option at a strike price of $1,950 for a premium of $50 an ounce.

If gold reaches $2,100, your option is “in the money.” You can sell at $2,100 and buy at $1,950, making a net $150 profit per ounce, less the $50 premium, or a $100 net gain.

If gold remains below $1,950, the option expires worthless. Your loss is limited to the $50 premium.

For a put option, if you expect that gold will drop, you can buy one with a strike price of $1,850. When gold drops to $1,700, you can sell at $1,850 and gain. If it does not drop, you lose only the premium.

Hazards in Investing in Gold Options

Gold options are exciting but bring hazards:

- Complication: Strike prices, premiums, and expiration take some learning.

- Limited Time: Options have a time limit until expiration, hence the price must move as expected before that.

- Loss of Premium: You risk losing the premium paid in case the option expires worthless.

- Market Volatility: Gold prices can vary depending on economic news, inflation, currencies, and worldwide news.

Getting Started with Gold Options

- Learn: Get familiar with the fundamentals of options and trading techniques.

- Select a Broker: Sign up for a broker that provides commodity options.

- Market Analysis: Monitor the gold price movement and market trends on a daily basis.

- First Trades: Start with small initial trades to understand how options are functioning.

- Consult a Professional: Consult a money advisor to make options suitable for your requirements and risk tolerance.

Things to Be Aware of When Trading Gold Binary Options

When considering trading gold binary options as the underlying asset, you should be aware of the risks. Gold is a volatile commodity, so its price will go up rapidly but will not fall as fast. This makes the gold options exciting, but unpredictable as well.

When dealing with binary options within extremely short time frames, the typical patterns within gold prices may not always hold true. For instance, anticipated triggers such as inflation announcements or government austerity measures may fail to materialize, and it becomes more difficult to anticipate price movements.

Because prices of gold fluctuate as much as 30%, one must take both market fluctuations and the psychology of gold consumers into account. There are risks involved in trading gold binary options, but there is also the potential for profit for shrewd and astute investors familiar with the market.

Conclusion

Gold options are an adaptable method of trading and investing in gold without taking delivery of the physical metal. They allow you to capitalize on increasing or decreasing gold prices using call and put options. Having a lower initial investment and limited risk to the premium paid, they attract investors as well as speculators.

But gold options carry a learning process, volatility, and expiration date risks. It is effective only if you know how options operate, choose the right strike price and expiry, and practice risk management.

For those who are ready to learn, gold options are a cheap, versatile way of gaining access to the gold market. If you want alternatives to traditional gold investing, gold options are a good place to start.