Purchasing a home is one of the largest financial decisions most individuals will ever make. Having the right mortgage to finance that house is extremely important. But finding the best mortgage can be confusing and take a long time.

This is where a mortgage broker can truly assist. Employing the services of a mortgage broker can be beneficial to you in numerous ways that simplify, speed up, and make sense to get a mortgage. This blog will explain how employing the services of a mortgage broker can be the most optimal choice to secure a better deal for your house loan.

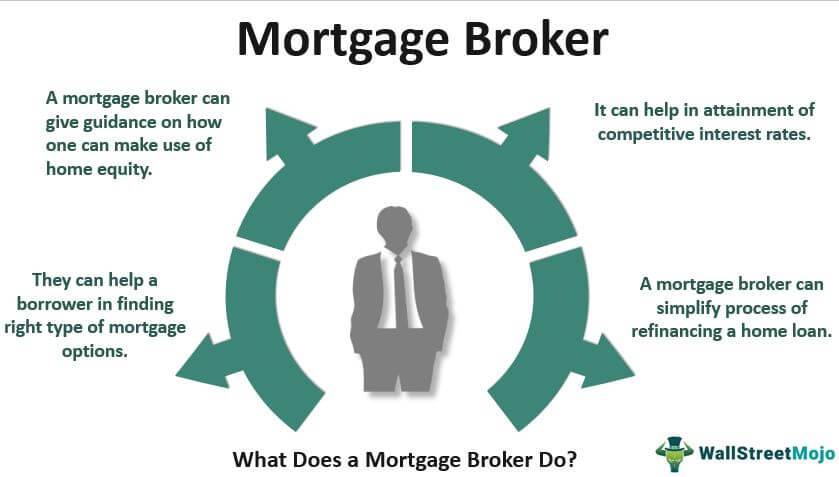

How Does a Mortgage Broker Help You?

When you work with a mortgage broker, they first find out about your finances and the kind of house you are interested in purchasing. Then, they begin shopping around for various mortgage plans from numerous lenders. They compare interest rates, payback periods, as well as any promotional offers to decide which suits you best.

Then, the broker describes all the options in plain language and assists you in selecting the one that suits you best. They also assist you in completing forms, making applications, and communicating with lenders. If there are any problems, they fix them in no time. Essentially, a mortgage broker is by your side right from the beginning until you have acquired the keys to your new property.

Why Should You Use a Mortgage Broker?

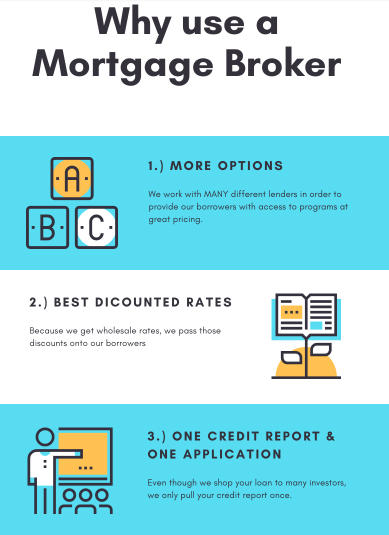

Access to More Lenders and Improved Terms

One of the largest benefits of utilizing a mortgage broker is that they can match you with numerous lenders. As opposed to approaching a bank directly, where you only get their terms, brokers can present you with loans from dozens of banks, credit unions, and private lenders.

They usually come with special offers or reduced interest charges due to their connections with lenders, deals that ordinary borrowers might not receive. By using a broker, you are likely to find better loan terms and lower rates, which can amount to saving a tremendous amount of money in the long term.

Saves Time and Effort

Mortgage shopping on your own can be time-consuming. You need to call numerous lenders, complete paperwork, and comparison shop. Mortgage brokers do everything for you. They collect information, negotiate with lenders, and compare loans in one location. This saves you hours or even weeks of your time and enables you to make a sound decision quickly.

Expert Advice and Personalized Support

Mortgage brokers are home loan professionals. They know interest rates, fees, and loan terms. They can offer advice that is appropriate for you.

When you buy a house for the first time, if you are self-employed or have bad credit, brokers can guide you toward the right loan. They also simplify jargon terms to plain language and answer all your questions, thereby making it simpler.

Improved Negotiation Strength

Mortgage brokers deal with a large number of lenders every day, so they are skilled negotiators. They can negotiate lower interest rates, reduced fees, or better repayment conditions on your behalf. This can prove to be useful if your circumstances are exceptional or require special attention. Their negotiating skill will often allow them to negotiate more favorable mortgage conditions compared to dealing directly with the lender.

No Extra Cost to You

Most mortgage brokers are paid by the lenders when a loan is finalized. That is, you usually get their services at no cost. You get expert advice and access to several lenders without extra charges. However, it would be wise to ask about any charges beforehand, since some brokers may have other charging policies.

Helps People with Special Financial Situations

If you have experienced credit issues, you are self-employed, or you have experienced other financial issues, you might struggle to obtain a mortgage. The mortgage brokers know which of the lenders are understanding or have expertise in these kinds of issues. They can find loans for you that you may not be able to locate on your own.

Simplifies the Mortgage Process

It takes a long process of pre-approval, application, paperwork, and closing to take out a mortgage. Mortgage brokers do it all for you. They fill in all the forms correctly and submit them on time. Time, error, and tension are saved, and your purchase is smoother.

Tips for Choosing the Right Mortgage Broker

Not all mortgage brokers are created equal. Take care to choose one who is honest, experienced, and has great reviews. Ask your relatives or friends for referrals. Ensure the broker is registered and licensed with the appropriate authorities. A good broker will explain their fee clearly, cover all your choices, and always act in your best interest.

Conclusion

Mortgage brokers make home buying and refinancing easier. They offer access to more lenders, save you wasted time, present professional expertise, and even lower your rates. If you have a strange financial scenario, a broker is particularly useful because they can get you the best deal for you, sometimes at no additional expense. The proper broker can make your mortgage experience easy.